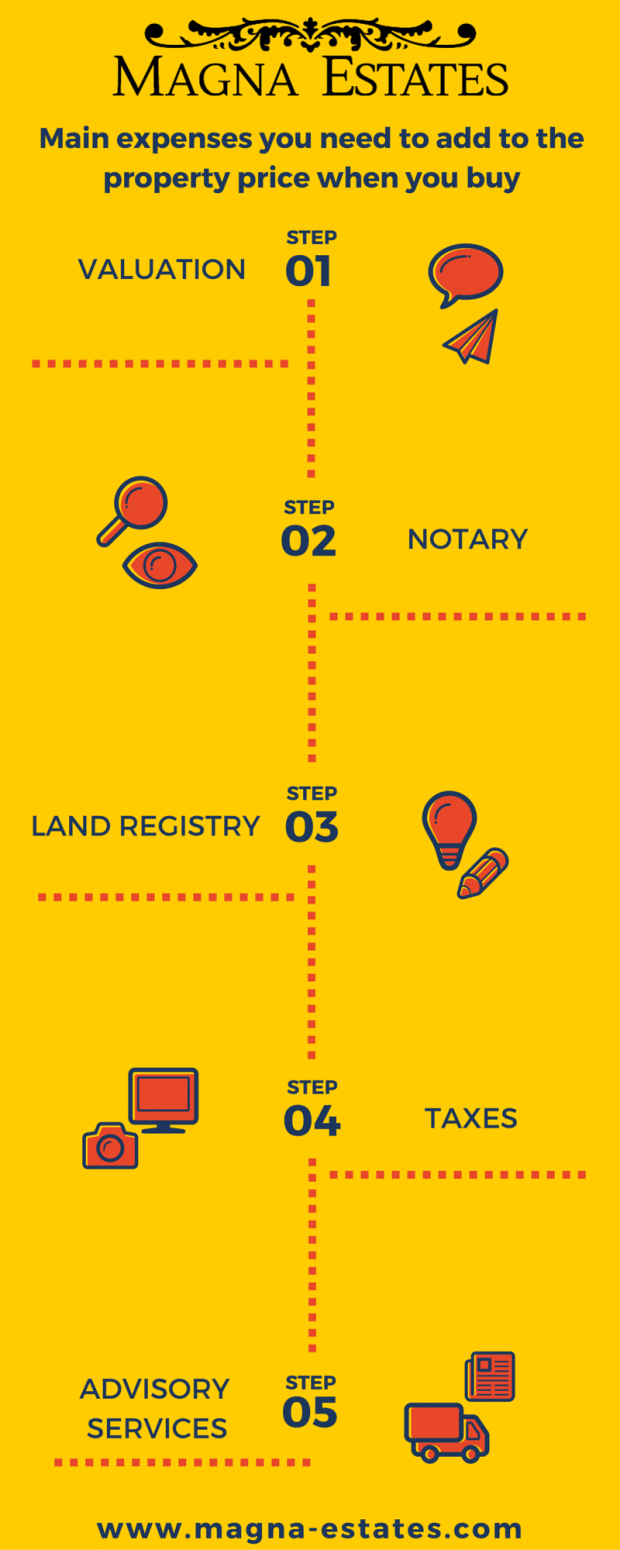

Buying a property is one of the most important economic decisions you ever make, and you must calculate the expenses well, as it is not just the property price that you must pay for. Indeed there is a series of fixed expenses which are generally calculated according to the type and price of the property.

In addition to the property price, you must consider other expenses such as valuation, notary, registration, taxes, and advisory services. As a way of example, for a property that costs 250,000 Euros you would need to add around 1,850 Euros for all those extra expenses.

1.- Valuation

After entering into a deposit or purchase agreement, the bank where you have applied for a mortgage will request a property valuation to know if the price does correspond to the property value, which is anyway convenient for the buyer too. The cost will depend on the property type and size. An average valuation can cost between 250 and 350 Euros (approximate amount).

2.- Notary

Once the transaction is agreed and the bank gives you a mortgage, a notary has to grant the public deed of sale, that is, certify the ownership change. His/her fees depend on the property price though such fee may vary, for example, if there are guarantors, the number of deed copies issued, or even the deed extension. Taking the example above again, for a property of 250,000 Euros, the notary expenses could be around 400 Euros.

3.- Land Registry

Registering a deed of sale with the corresponding Land Registry –to record evidence of the public document – also costs money. In a case like the one above, you would need to add around 350 Euros (approximate amount) to the actual property transaction expenses.

4.- Taxes

This is the expense’s section where the buyer has to pay more. You have to differentiate between new and second hand properties. If you buy a new property, you need to pay 10% of VAT (25,000 Euros for the property of 250,000 Euros of our previous example).

For a second hand one, you need to pay the Property Transfer tax (Impuesto de Transmisión de Patrimonio) which in Andalusia is 8% in the case of properties of up to 400,000€, and 9% for properties with a price between 400,001€ and 700,000€, and 10% for properties over 700,001€.

In both cases, whether it is a new or a second hand property, you need to add the stamp duty (Impuesto de Actos Jurídicos Documentados), which represents 1% of the property price and corresponds to the notary signing and registering the deed with the Land Registry.

5.- Advisory services

Finally there is the advisory company (gestoría) that works for the bank which makes all the tax payments on your behalf and does part of the paperwork. It is difficult to generalize in this case, but expenses can be around 250€.